FAQ

FAQFrequently

Asked Questions

Browse the below frequently asked questions in order to find the answer to your question, or contact us for other questions.

The procedure for making an application can be done by coming directly to our nearest branch office or can contact us at the following numbers:

Free Hotline: 0800-1900-500 SMS/Whatsapp: 0818-0390-0500

Bina Grup loan application requirements, namely:

1. Minimum age 21 years old (never married) or 18 years old (already/ever married)

2. Own or want to start a small business

3. KTP and KK (original and photocopy) of the prospective partner, heirs (if any) and person in charge

4. Supporting documents such as SKD, driver's license or marriage certificate (if required) 5.

5. For new groups, minimum 8 members

The conditions for applying for a Bina Usaha loan, namely:

1. Minimum age of 21 years (never married) or 18 years (already/ever married)

2. Own a business

3. KTP and KK (original and photocopy) of the prospective partner, heirs if any and the person in charge.

4. Supporting documents such as SKD, driver's license or marriage certificate if required.

5. Must include collateral, can be in the form of BPKB motorized vehicles, business equipment, and household appliances

Plafond for Group Lending:

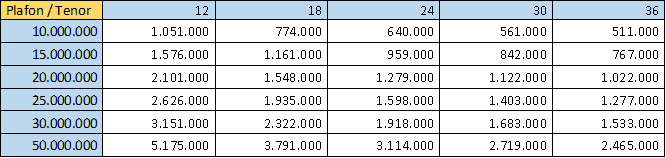

Plafond for Individual Lending:

Group Lending Application:

There are no collateral requirements. The collateral required is the cohesiveness of the group.

Individual Lending Application:

What can be pledged are as follows:

a. BPKB of Motor Vehicle

b. Business Equipment

c. Household Appliances

To submit a partner death insurance claim, you can submit it to the relevant Branch by submitting the following documents:

1. Proof of Death

2. Partner's ID card and family card

3. KTP and KK of the Insured / Beneficiary

4. Financing Application Submission Form

5. Loan and disbursement agreement

Additional Documents for Individual Lending Partners:

1. Third party claim form (in this case AXA/Allianz)

2. Copy of Partner's marriage certificate

3. If the heirs are different from the time of registration, they must attach a “Certificate of Heirs” from the authorized party and the KTP and KK of the replacement heirs as stated in the Certificate of Heirs.